Thin Clients at Wal-mart and and Bed & Bath

Thin client the key to fat prospects for Neoware Systems

Athena D. Merritt

Special to the Business Journal

KING OF PRUSSIA -- Past the shelves of scented candles at Bed Bath & Beyond, the assemble-it-yourself furniture at Ikea and rows of marked-down goods at Walmart, brews success.

The thin client appliances of Neoware Systems are at work in each chain, putting databases of information at fingertips without hard drives or the cost and staff required by traditional desktop computing systems.

"Virtually any business could use them. We are seeing the greatest success in companies that want to more closely manage their personal computers," Chairman and CEO Mike Kantrowitz said.

Thin client appliances, which emerged in the 1990s, do not have a hard drive or local storage, allowing users to instead access information from a centrally managed server via a wired or wireless network. The systems are most popular in the retail, health care and transportation industries, but are making inroads in branch banking and airlines because they provide access to a database and wide disbursement with minimal systems support.

"We have environments where customers are managing as many as tens of thousands of our appliances without adding staff," said Kantrowitz, who noted that the standard benchmark for personal computer support is one system administrator per 50 computers.

Among other benefits offered by thin client appliances, both Kantrowitz and industry analysts said, is a system virtually immune to PC viruses and more secure, reliable and less expensive. Neoware's products start at under $200.

"Thin clients are inherently more secure -- everything has to come through one point," said Bob O'Donnell, director of personal technology for IDC, a global market intelligence and advisory firm in information technology and telecommunications. "It's like forcing everybody through the front door, and you can heavily guard the front door and your place is a lot safer than if you have several doors people can get into."

The market for the products, which represent just 1 percent of PCs sold worldwide, is still small, but competitive, with only a few major players.

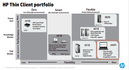

Established in 1995 through a merger between a private technology company and Human Design Systems of Philadelphia, Neoware has battled to second in market share both domestically and worldwide, O'Donnell said. Wyse Technology holds the top slot, with Hewlett-Packard third.

Neoware focused on thin client appliances after a profitable 1990s entry into the marketplace left it floundering in 1999 and 2000. The difficult years resulted in the firm converting from a hardware focus to a software focus, Kantrowitz said.

"We competed with hardware companies, but we provided companies with thin client software that allowed them to convert from personal computers to thin clients and solve the security and management and cost problems that come along with personal computers," he said.

Competing with about 20 players, Neoware's new strategy secured just three percent of the marketplace and left it seventh in terms of market share in 2000. But organic and acquired growth have since propelled the company to a position holding just under 20 percent of the overall market, Kantrowitz said.

In August, Neoware landed eighth on Fortune Magazine's annual list of the 100 fastest-growing companies. And in September, with 439 percent growth between 1999 and 2003 as an achievement, Neoware landed 18th on Deloitte & Touche's ranking of the region's 50 fastest-growing technology companies.

"They've gotten there a couple of ways -- one is they focused on purchasing other players in the industry," said industry analyst James McIlree of C.E. Unterberg, Towbin.

Neoware's acquired growth began in 2001 with the acquisition of Boundless Technologies' thin client business in New York and Activ-E Solutions in Pennsylvania, Kantrowitz said.

In 2002 and 2003, the thin client businesses of Acquired Network Computing Devices in California and IBM, respectively, were acquired.

And in September, Neoware obtained the thin client business of Visara International, broadening the firm's prospective IBM customer base. The line includes Linux-based thin client solutions that connect to mainframes and midrange systems via older network infrastructures, which more than 30 percent of enterprise customers still use, according to a TechRepublic study.

"There is still a big number of what are called 'green screens' out there and a number of them are IBMs," McIlree said, indicating that there are estimates of 30 million to 40 million green screens. "It's a big market for them to go after, and having access to where those bodies are buried or where those customers are is a big advantage to them."

By 2008, IDC forecasts the thin client market will represent the equivalent of 10 percent of the enterprise desktop PC market.

"One of the biggest challenges facing the thin client industry is lack of interest; people simply don't know of thin clients," O'Donnell said.

This site is produced by

This site is produced by