Jeff Vance of Datamation lays out top five hardware vendors. He has HP, Wyse, & NComputing as top three (no surprise there). Thought I might see Sun, and up and coming Dell should not be underestimated.

Top Five Thin Client Hardware Vendors — Datamation.com

With the rise of cloud computing, it's a good time to be a thin client vendor. According to Global Industry Analysts, the global thin client market will expand to 14.36 million units shipped by 2015.

Meanwhile, IDC believes that more than a 1.2 million thin clients will ship in 2010, an increase of 20 percent over 2009. Sounds great if you have a short memory. Anyone paying attention to this market sector has heard this before. IDC made many similar bold predictions in the past.

For instance, in 2003 IDC predicted that the market would expand to 3.4 million units by 2007. Obviously, growth lags behind earlier predictions.

This isn't meant to beat up on IDC. Sure, they were overly optimistic, but so was everyone else. Other analysts and such vendors as Oracle, Sun and Microsoft all made similar proclamations.

What's different this time? Several things. First, the in-the-office-all-day-long workforce is becoming a thing of the past. Next, broadband penetration is up, even if it still lags behind were it should be in the U.S. Smart phone adoption is also up, meaning more and more end users are getting comfortable accessing the Internet on devices other than PCs.

Email Article

Print Article

Comment on this article

Share Articles

Meanwhile, organizations are beginning to realize that virtual desktops may be a heck of a lot easier to secure, manage and maintain than full-blown ones.

Finally, the biggest factor benefiting thin clients is the convergence of virtualized infrastructures with cloud computing. This technology perfect storm means thin client adoption is a "when," not "if" scenario. As the market evolves, will today's thin-client leaders, such as Wyse, NComputing and Pano Logic, gain the same sort of brand recognition that Microsoft, Apple and HP do today?

It's too early to tell, but what we do know is that the following five vendors are well positioned to take advantage of this burgeoning market.

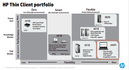

1. HP

Why they're a thin client leader today: HP's acquisition of Neoware in 2007 vaulted them to the top of the thin client market. Gaining market share via acquisition doesn't necessarily make you a "leader," if the definition of "leader" you're using is synonymous with "visionary." In this case, however, HP both gained market muscle and displayed insight.

With many of its hardware platforms threatened by the looming post-PC era, HP has taken steps to help it avoid repeating the mistakes IBM made in the 1980’s and 90’s.

Why they could be on top in years to come: Versus the other competitors in this market, HP's main advantage is its sales channels. Others, such as Wyse, may have been playing the thin client game for longer, but they'll have a tough time reaching the same number of customers. While other competitors are hyping up “zero clients,” HP is focusing on “mobile thin clients,” which we see as a smart move. The zero client concept certainly has its appeal, but not quite the raw appeal of “mobile.”

HP’s mobile thin clients are basically laptops preloaded to work with virtualized environments. Not terribly revolutionary, but HP seems to be positioning itself to push the virtual desktop to other mobile devices as the market matures.

While the zero client message is tailored for enterprise customers, mobile clients appeal to businesses and consumers alike. When it comes to gadgets, innovation is often driven on the consumer side before spilling over into the enterprise, so this is no trivial distinction.

Customers: Domino’s Pizza, Seismic Micro-Technology, Noodle’s & Company, Apache Junction Unified School District and JetBlue.

2. Wyse Technology

Why they're a thin client leader today: Wyse was the leading thin client vendor until HP jumped ahead with its purchase of Neoware. Today, Wyse is a close number two, and according to IDC, together HP and Wyse own roughly 70% of the market.

Wyse has an impressive product portfolio, offering everything from standard desktop thin clients to mobile ones. Moreover, Wyse’s PocketCloud technology, which allows users to manage their virtual desktops from iPhones, iTouches and iPads, is ahead of anything else in the market.

This site is produced by

This site is produced by